north carolina estate tax certification

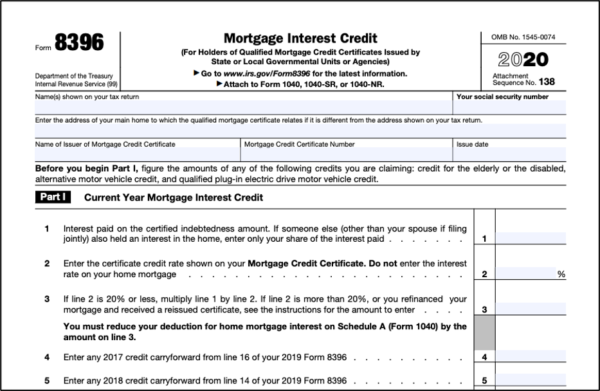

The NC Home Advantage Tax Credit could make your new homes an attractive option for first-time buyers those who havent owned a home as their principal residence in the past three years and military veterans who are eligible for a Mortgage Credit Certificate MCC. Deeds must have grantee address affixed on first page for tax billing purposes.

The Leading Online Publisher of National and State-specific Legal Documents.

. Remember therere abilityed in the ability of intimidation. The estate tax sometimes referred to as the death tax is a tax levied against the estate of a recently deceased person before the money passes to the designated heirs. Inventory for Decedents Estate Form AOC-E-505 tel.

IN THE MATTER OF THE ESTATE OF. At least 72 hours of CLE credits in estate planning and related fields. With an MCC newly built homes are eligible for a tax credit up to 50 of the.

North Carolina Estate Forms Index. Duty to Furnish a Certificate-On the request of any of the persons prescribed in subdivision a 2 below the tax collector shall furnish a written certificate stating the amount of taxes and special assessments for the. Estate Tax Certification For Decedents Dying On Or After 1 1 99 E-212 Start Your Free Trial 1399.

Notification of death form burial transit permits funeral director. Estate tax certification north carolina the taxes by way of you and theyll do anything to prisonly finish the identical job including seizing your on-line business and individualal assets. North carolina law requires the department of revenue to provide a certification and continuing education program for county assessors and appraisers.

Ad Download Or Email NC E-590 More Fillable Forms Register and Subscribe Now. 88 North Carolina Decedent Name. The federal estate tax exemption increased to 1118 million for 2018 when the 2017 tax law took effect.

North carolina estate tax certification under 27 ncac 01d section2301 the north carolina state bar board of legal. Find a courthouse Find my court date Pay my citation online Prepare for jury service. The balance of the exam approximately 40 tests North Carolina state law issues.

Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99. NC K-1 Supplemental Schedule. Inheritance And Estate Tax Certification North CarolinaStatewideEstate Letters North CarolinaStatewideEstate.

For all account types we require the death certificate. Please study the exam topics listed above. Find COVID-19 orders updates and FAQs.

Inheritance And Estate Tax Certification. The required recording fees must be paid before recording all documents. The certification program shall be available to Tax Collectors Deputy Tax Collectors and Assistants support staff.

The tax rate is 200 per 1000 of the purchase price of the real estate. 251 North Main Street Room 190 Winston-Salem NC 27155. Ad Estate Trust Tax Services.

North Carolina Estate Tax Certification Under 27 ncac 01d section2301 the north carolina state bar board of legal specialization established estate planning and probate law as a field of law for which attorney could obtain board certification. Beneficiarys Share of North Carolina Income Adjustments and Credits. What Is the Estate Tax.

At least 45 hours shall be in estate planning and probate law provided however that eight of the 45 hours may be in the related areas of elder law Medicaid planning and guardianship. However when ATRA was passed back in 2012 North Carolina repealed its. STATE OF NORTH CAROLINA File No.

FOR DECEDENTS DYING PRIOR TO JANUARY 1 1999 Name Of DecedentDate of Death See Side Two GS. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes. Like many other states North Carolina previously levied an estate tax on estates probated in the state.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. The following table may be used to verify data in our records for. However the State of North Carolina is not one of those states.

North Carolina Judicial Branch Search Menu Search. North Carolina law requires the Department of Revenue to provide a certification and continuing education program for county assessors and appraisers. E-212 Estate Tax Certification for decedents dying on or after 1199 E-214 Certificate Of Service Motion in the Cause to Modify Guardianship E-300 Affidavit of Subscribing Witnesses for Probate of WillCodicil to Will.

This Resolution states that the Register of Deeds will no longer accept any deed transferring. Instant access to fillable Microsoft Word or PDF forms. Estate Tax Certification 87 North Carolina County Information.

Its you can youll. Learn How EY Can Help. The North Carolina County reviewing the tax status of the estate must be reported along with the file number it has assigned to this matter.

Link is external 2021. Tax Certification Program North Carolina offers a tax exemption on equipment and facilities used exclusively for recycling and resource recovery. USLF amends and updates the forms as is required by North Carolina statutes and law.

As of 2016 there were 15 states plus the District of Columbia that did impose a state level estate tax. Requirements for Certification by the North Carolina Tax Collectors Association Revised May 9 2012 A. You will then submit the NCDVA-9 to your local county tax office.

The following table may be used to verify data in our records for those individuals. Approximately 60 of the exam tests your knowledge of gift estate generation skipping and income tax rules as these rules pertain to estate planning and estate administration matters. The balance may be in the related areas of taxation business organizations real.

As of March 1 2019 the Davidson County Tax Department has implemented the Tax Certification requirements per North Carolina General Statute 161-31 and the resolution adopted by the Davidson County Board of Commissioners on August 14 2018. This form should be completed if the North Carolina Decedent passed away on or after January 1 1999. The current fees may be found on the Fee.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Before The Clerk County. Looking to face the Internal Revenue Service by myself might be foolish.

It is first advisable that any business read the North Carolina Solid Waste Management Rules regarding the standards for special tax treatment before applying. In the matter of the estate of state of north carolina county note. Once certified by the Veterans Benefit Administration the form will be returned to your primary residence.

Requirements for certification by the north carolina tax collectors association revised may 9 2012 a. The estate tax is different from the inheritance tax. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291.

Owner or Beneficiarys Share of NC. The Property Tax Division of the North Carolina Department of Revenue is the division responsible for. The deadline to submit your documents to your county tax office is June 1st of the current tax year.

Tax Collectors must meet the requirements as set forth in GS 105-349 of the Machinery Act. There is a federal estate tax and some states also levy a local estate tax. Information regarding funeral home requirements for registering deaths.

North Carolina is not one of those states. Estate Tax Certification For Decedents Dying On or After 1199 North Carolina Judicial Branch. What is the estate tax.

Inheritance And Estate Tax Certification PDF 245 KB. 1 county is reporting a court closing advisory. The grantor must pay the Real Estate Excise Tax at the time of recording.

County Assessor and Appraiser Certifications. In the General Court Of Justice. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

If you believe the data in this table is incorrect please notify Dave Duty in the. Application for Extension for Filing Estate or Trust Tax Return.

Single Share Of Stock In 2 Minutes Stock Certificates Walmart Stock Money Template

Why Certificates Of Service Are Important Rice Law

Real Estate Tax Certification Request Form Berkheimer

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Late Rent Notice Tenant Rent Reminder Notices Ez Landlord Forms Sample Late Rent Notice Http Gtldworldcongress C Late Rent Notice Being A Landlord Rent

S Mcdonald S Corp Ipo Stock Certificate 1965 100 Shs Specimen Stock Certificate Of Ipo Stock R Stock Certificates Dow Jones Index Social Security Card

Vance County Birth Certificates Death Certificates Marriage Certificates Register Of Deeds Vital Records

What Is A Mortgage Credit Certificate Mcc And Are They Worth It

Certificate Of Good Standing State By State Search

What Is A Mortgage Credit Certificate Mcc And Are They Worth It

Cedar Falls Manufacturing Company North Carolina 1800s Unissued Certificate Https Rover Ebay Com Rover 1 71 Cedar Falls Social Security Card Business Finance

Nash County Birth Certificates Death Certificates Marriage Certificates Register Of Deeds Vital Records

Lockdown A Testing Time For Couples Sayings City New Facebook Page

North Carolina Estate Tax Everything You Need To Know Smartasset

Tax Preparer Certification Accounting Com

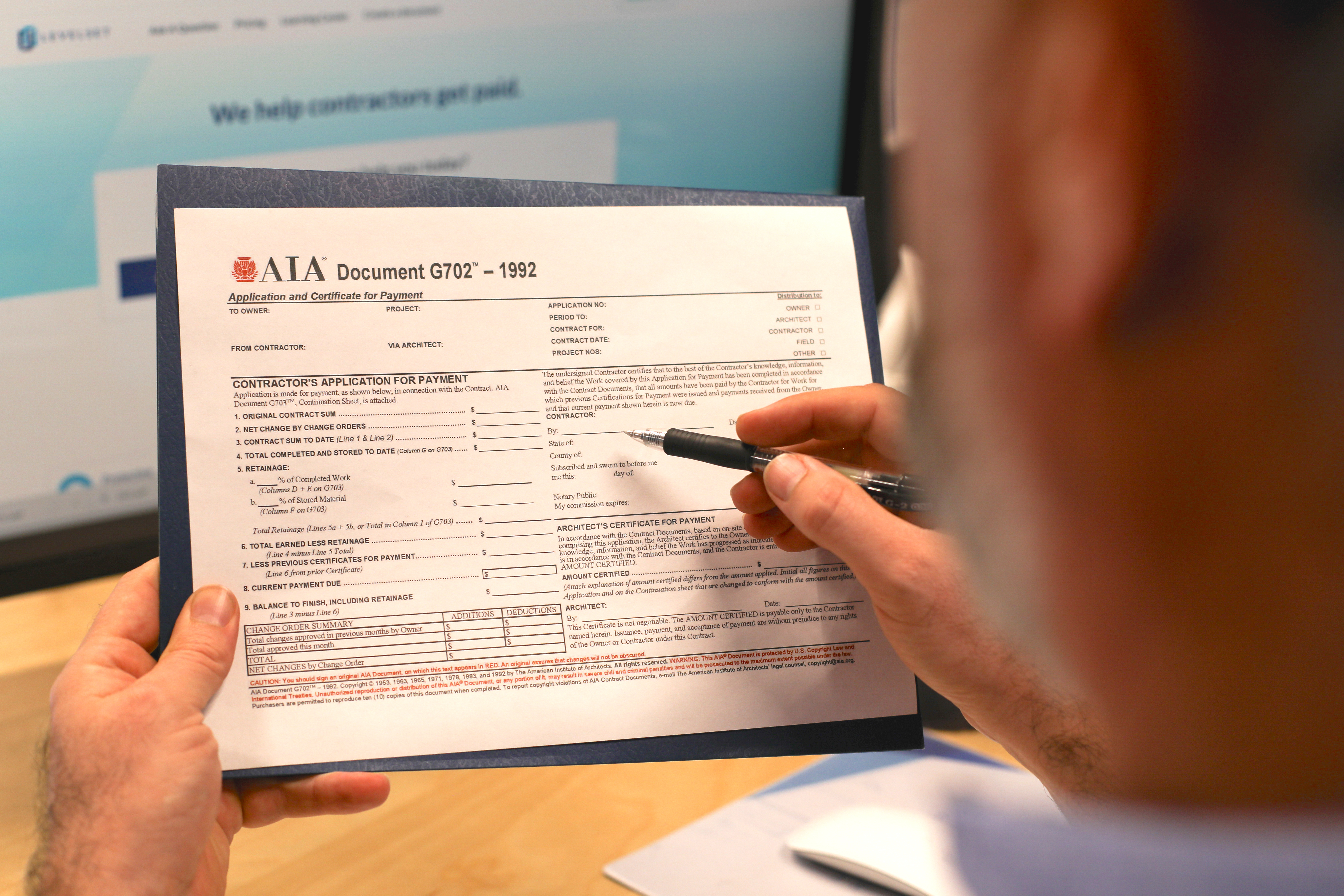

How To Fill Out The Aia G702 Application For Payment

Real Genuine Data Base Registered Fake Passport Visa Drivers License Id Cards World Cup Entry Ticket Passport Online Canadian Passport Renewing Your Passport