south dakota sales tax rate 2021

Business Frequently Asked Questions. Look up 2022 sales tax rates for Smithwick South Dakota and surrounding areas.

South Dakota Estate Tax Everything You Need To Know Smartasset

Find information tax applications licensing instructions and municipal tax rates for the Sturgis Motorcycle Rally.

. The South Dakota Department of Revenue administers these taxes. 06-01-2021 1 minute read. 31 rows The state sales tax rate in South Dakota is 4500.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Tax rates are provided by Avalara and updated monthly. With local taxes the.

What is the sales tax rate in Rapid City South Dakota. The minimum combined 2022 sales tax rate for Sioux Falls South Dakota is 65. One field heading that incorporates the term Date.

Beginning July 1 2021 four South Dakota communities will implement a new municipal tax rate. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. Average Sales Tax With Local.

Exact tax amount may vary for different items. This is the total of state county and city sales tax rates. Look up 2021 South Dakota sales tax rates in an easy to navigate table listed by county and city.

Municipalities may impose a general municipal sales tax rate of up to 2. The South Dakota sales tax rate is currently 45. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65.

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. South Dakota has a 450 percent state sales tax rate a max local sales tax rate of 450 percent and an average combined state and. The minimum combined 2022 sales tax rate for Rapid City South Dakota is.

Rate search goes back to 2005. Tax rates are provided by Avalara and updated monthly. The municipal tax changes taking effect.

One field heading labeled Address2 used for additional address information. Free sales tax calculator tool to estimate total amounts. Find your South Dakota.

The base state sales tax rate in South Dakota is 45. South Dakota also does not have a corporate income tax. They may also impose a 1 municipal gross.

In addition to taxes car. Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. The 65 sales tax rate in Sioux Falls consists of 45 South Dakota state sales tax and 2 Sioux Falls tax.

Municipal governments in South Dakota are also allowed to collect a local-option sales tax that. All car sales in South Dakota are subject to the 4 statewide sales tax. 4 January 2021 Municipal Tax Guide South Dakota Department of Revenue Tax Application on Special Devices Special Jurisdictions Currently five Indian tribes in South Dakota have.

South Dakota has a statewide sales tax rate of 45 which has been in place since 1933. 2022 South Dakota state sales tax. This is the total of state county and city sales tax rates.

There is no applicable county tax or special tax. The sales tax jurisdiction name is. The South Dakota sales tax and use tax rates are 45.

Is the sale or purchase of. South Dakota Department of Revenue Municipal Tax Guide July 2021 3 Glossary of Terms South Dakota law SDCL 10-52 and 10-52A allows municipalities to impose a municipal sales. Look up 2022 sales tax rates for Cresbard South Dakota and surrounding areas.

366 rows 2022 List of South Dakota Local Sales Tax Rates.

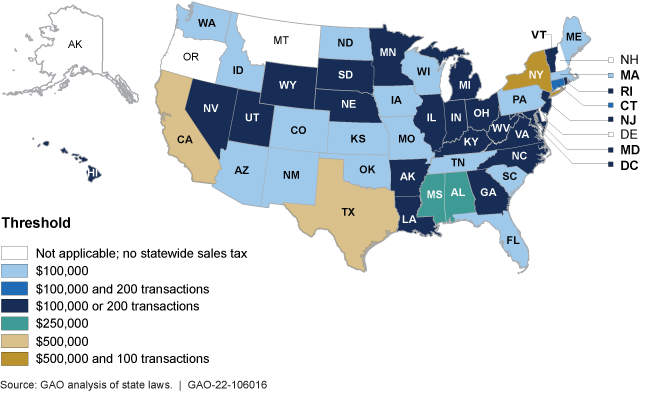

Economic Nexus State Chart State By State Economic Nexus Rules Sales Tax Institute

South Dakota Sales Tax Small Business Guide Truic

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

State Sales Tax Rates Sales Tax Institute

Sales Tax Laws By State Ultimate Guide For Business Owners

How South Dakota Became A Haven For Both Billionaires And Full Time Rv Ers Marketwatch

South Dakota Estate Tax Everything You Need To Know Smartasset

Remote Sales Tax Initial Observations On Effects Of States Expanded Authority U S Gao

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

State Income Tax Reliance Individual Income Taxes Tax Foundation

Corporate Income Taxes Urban Institute

Sales Use Tax South Dakota Department Of Revenue

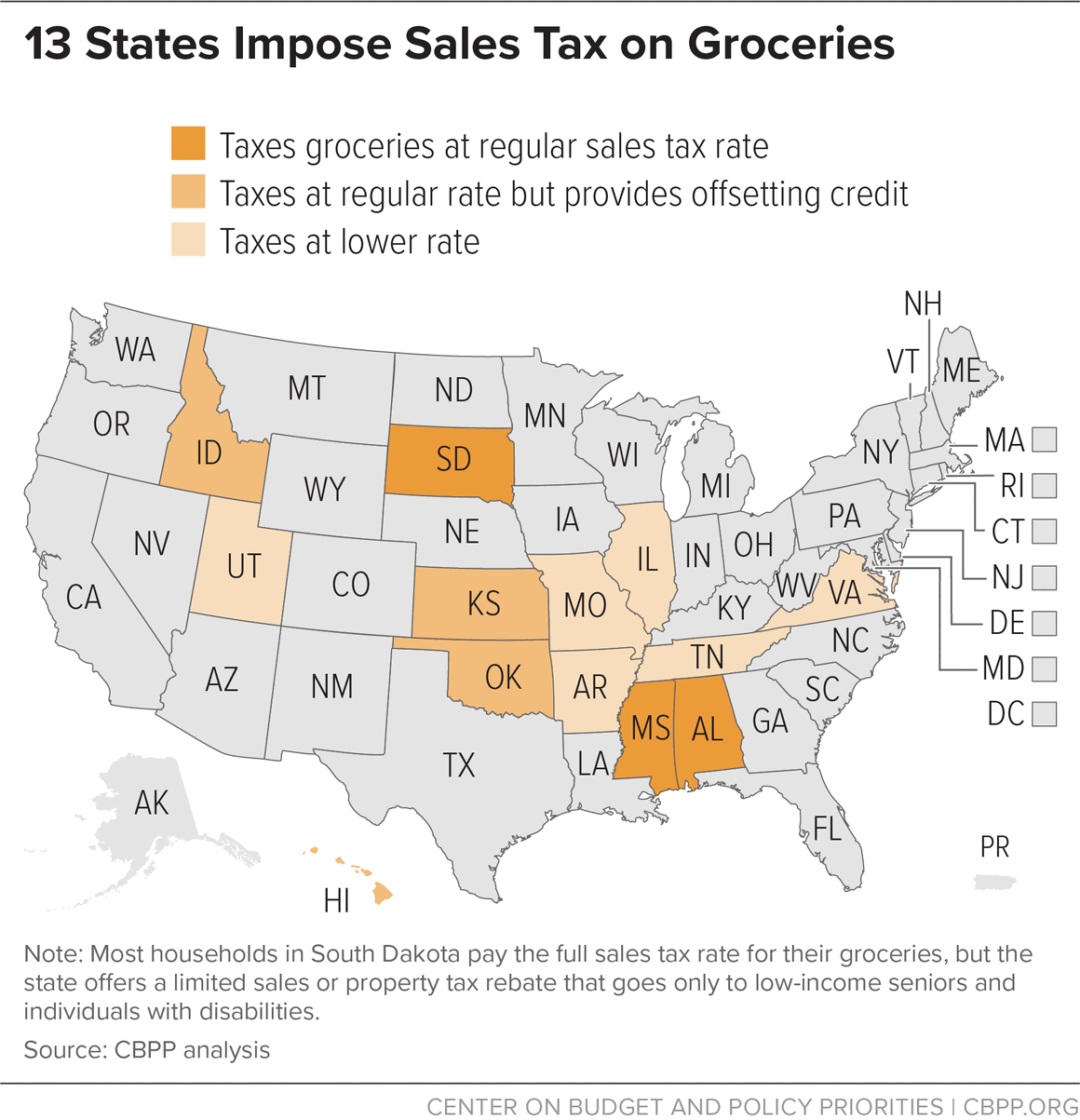

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

City Sales Property Tax Welcome To The City Of Brandon Sd

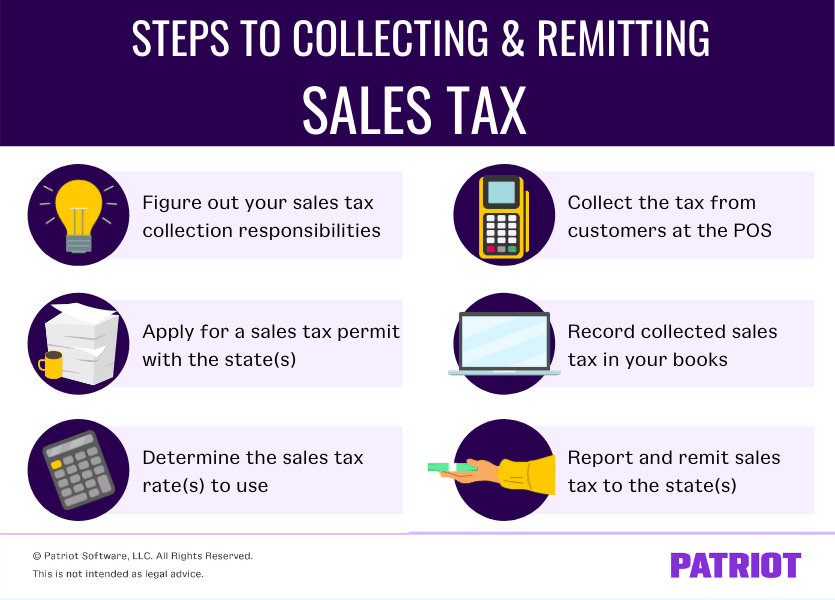

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Study Ranks How Tax Friendly Every State Is Newsnation

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation